Whereas the same old volatility has been absent from the derivatives market, the slight fluctuations seen prior to now few days nonetheless managed to disclose refined market tendencies.

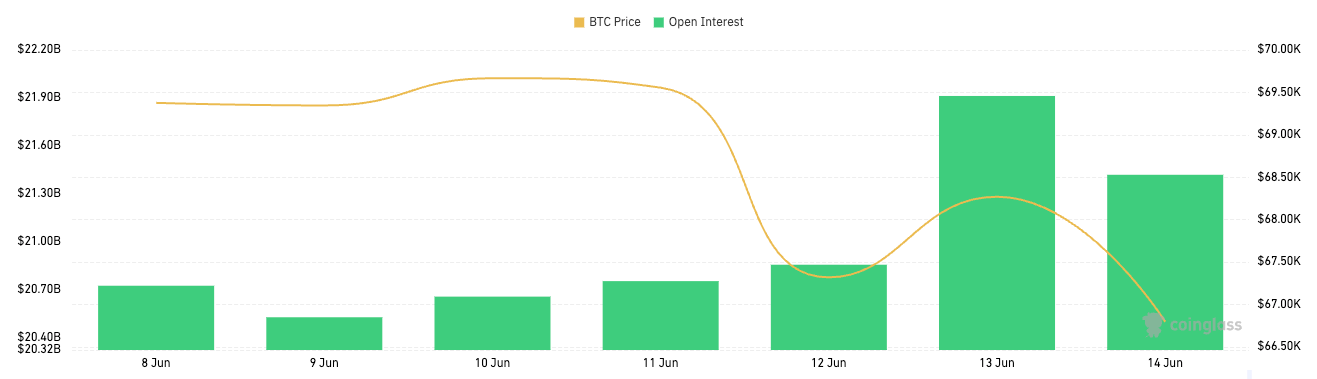

Between June 12 and June 14, Bitcoin choices open curiosity elevated $20.85 billion on June 12 to $21.91 billion on June 13, earlier than reducing to $21.42 billion on June 14.

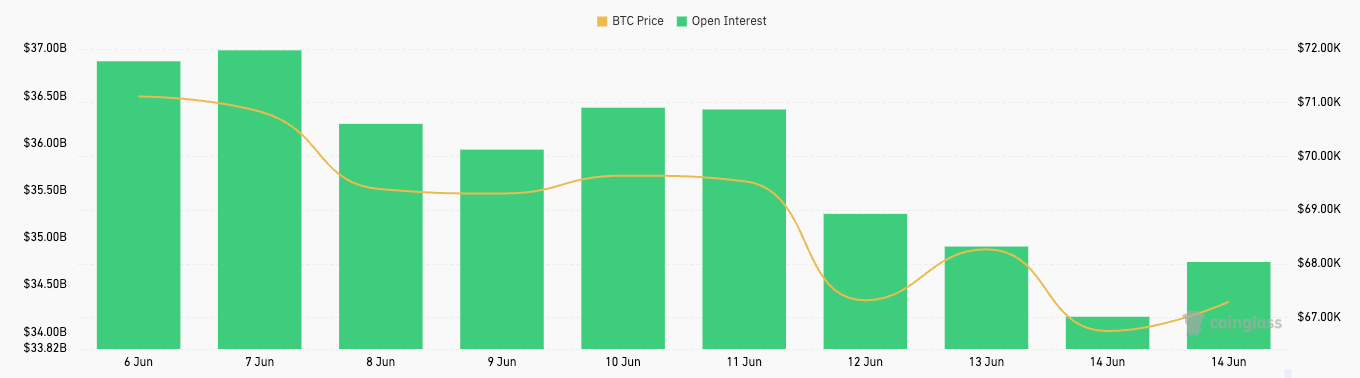

Open curiosity in Bitcoin futures additionally barely declined through the interval, falling from $35.25 billion on June 12 to $34.17 billion on June 14.

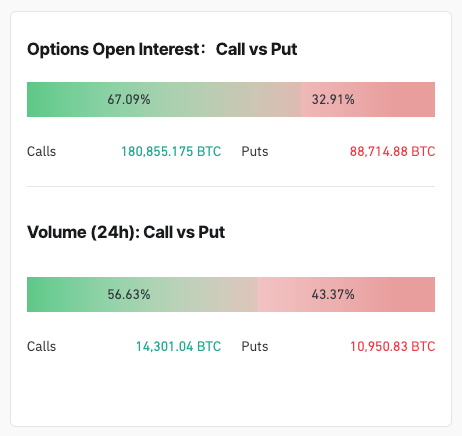

The preliminary enhance in choices open curiosity, adopted by a subsequent decline, suggests a fancy market sentiment when analyzed alongside value. Bitcoin dropped from $69,555 on June 11 to $66,780 on June 14, after a short restoration on June 13. The predominance of name choices (67.17%) over put choices (32.83%) as of June 14 signifies an general bullish sentiment regardless of the value drop. The 24-hour quantity for choices on June 14 additionally leaned in the direction of calls (59.88%), reinforcing this bullish outlook even in a declining value atmosphere.

These refined modifications in OI had been a results of a mixture of a number of elements influencing the broader crypto market. Bitcoin ETFs have skilled combined inflows and outflows prior to now a number of days. The rebound of Bitcoin ETFs with $100 million in inflows, juxtaposed with a pointy $226 million outflow amid Ethereum ETF information, exhibits simply how large of a success the market took. This outflow doubtless contributed to the decreased demand for Bitcoin futures, as evidenced by the declining open curiosity in futures.

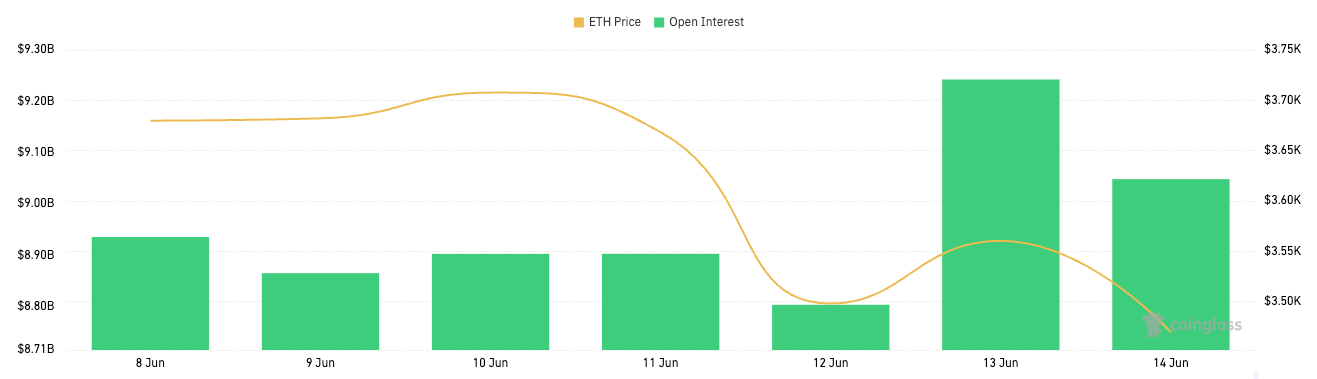

The decisive phrases from SEC’s Chair Gary Gensler that Ethereum ETFs will probably be authorised this summer season doubtless diverted investor consideration and capital in the direction of Ethereum, impacting Bitcoin’s derivatives market. This shift is clear in Ethereum’s future and choices market, the place open curiosity will increase prior to now few days mirror this alteration in sentiment.

MicroStrategy’s convertible be aware issuance to buy extra BTC additionally formed investor sentiment. Michael Saylor’s newest transfer demonstrates the corporate’s unwavering confidence in Bitcoin, which may definitely affect traders collaborating within the derivatives market. This affect is seen of their capability to keep up and enhance bullish positions regardless of a flat value, as seen within the dominance of name choices.

ETF outflows have a direct influence on Bitcoin futures and choices markets. Outflows from Bitcoin ETFs can result in diminished liquidity and demand within the futures market, inflicting a lower in open curiosity. This connection is clear from the information, the place we observe a decline in futures open curiosity following vital ETF outflows. The connection between ETF flows and futures open curiosity exhibits how essential institutional participation and sentiment are in driving the market.

Bitcoin’s sideways motion and lack of great volatility throughout this era have a dampening impact on open curiosity. When the value stays comparatively steady, merchants might discover fewer alternatives for revenue, resulting in diminished buying and selling exercise and decrease open curiosity in futures. The steady value vary of Bitcoin from June 10 to June 14, with minor fluctuations, suggests a interval of market consolidation, contributing to the noticed decline in futures open curiosity.