Over the previous few many years, technological advances and plummeting transaction prices have facilitated the emergence of a dizzying number of methods to achieve publicity to very particular areas of the market. Consequently, advicers have extra choices than ever so as to add worth for his or her purchasers by tailoring funding portfolios which can be particular to their distinctive wants, targets, and threat tolerance. One strategy that has change into more and more common is using factor-based ETFs, which are designed round sure shared traits of property that go be–yond the extra conventional attributes (e.g., measurement, business, location) of early mutual funds. Whereas there are actually a whole lot of identifiable elements, essentially the most well-known are High quality, Worth, Momentum, Small Measurement, and Minimal Volatility.

On this visitor publish, Robert Hum, a Managing Director and U.S. Head of Issue ETFs at Blackrock, discusses why High quality issue ETFs have seen massive inflows over the past 12 months, the traits that outline High quality, and the way advicers can implement High quality ETFs of their purchasers’ portfolios.

As we head in the direction of the second half of 2024, traders proceed to grapple with lots of the similar points which have influenced the general market motion for the previous a number of quarters. Whereas inflationary pressures have continued to development decrease and the roles market appears to have tightened considerably, the Federal Reserve stays in a wait-and-see mode in regard to any potential charge cuts, worldwide tensions stay elevated, and the extent of focus in a handful of (arguably overvalued) shares persists.

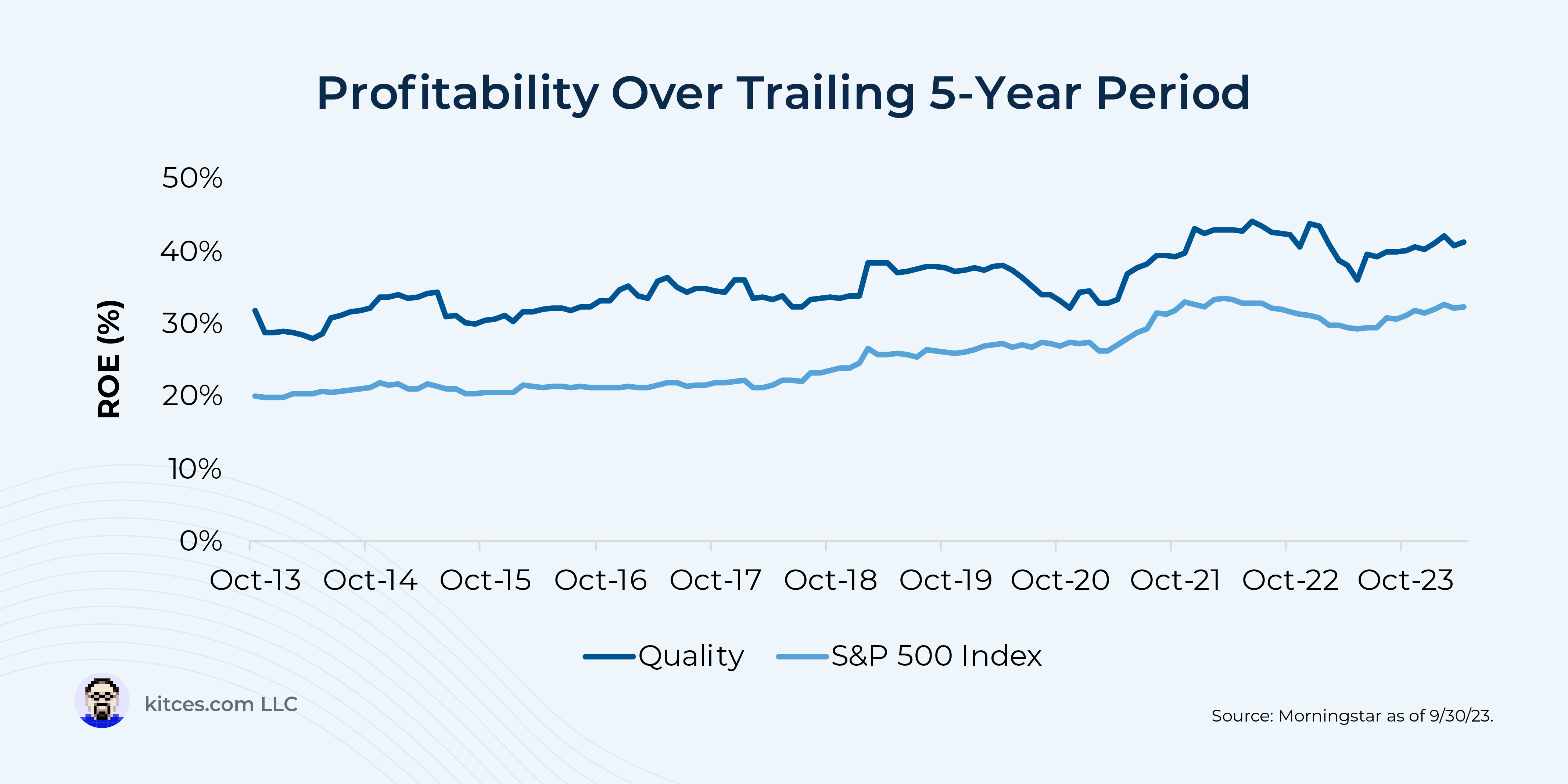

Consequently, this macroeconomic and market uncertainty has ostensibly pushed a desire for overweighting higher-quality firms in funding portfolios. Particularly, ‘high-quality’ firms share a number of related basic traits. As an illustration, analysis has proven that firms whose income is pushed by their core enterprise features (versus non permanent accounting transactions) are likely to have extra sustainable earnings and better future inventory returns. Leverage additionally comes into play, as corporations with decrease debt-to-equity ratios are much less dangerous, notably in high-interest-rate climates. Furthermore, firms which can be extra worthwhile (as measured by their return on fairness) are likely to outperform their less-profitable friends, even after accounting for the upper value multiples they usually carry… and that relative outperformance has tended to extend with longer holding intervals!

With these elements (no pun supposed!) in thoughts, there are 3 major ways in which advicers can use High quality ETFs in portfolios. First is from a tactical perspective, the place high quality methods that focus on firms with decrease debt-to-equity ratios have decrease complete curiosity bills and should be higher positioned to climate the present higher-for-longer charge regime. Second, advicers can use High quality ETFs strategically. High quality ETFs are likely to have a decrease ‘monitoring error’ compared to different factor-based merchandise and, subsequently, can be used as a large-cap blended fund. Lastly, High quality ETFs might be an efficient diversifier, notably in portfolios that are tilted towards the Worth issue.

Though High quality ETFs have already proven stable relative efficiency year-to-date, the longer-term case for High quality should be compelling, given persistently excessive rates of interest and the continuing macroeconomic headwinds. Advicers can add worth for purchasers who could also be involved a couple of doable financial slowdown by sustaining their total portfolio combine per a strategic give attention to an space that tends to point out relative energy throughout downturns. In the end, by providing purchasers methods to answer modifications within the financial cycle, advicers might help purchasers keep disciplined and targeted on their long-term targets!