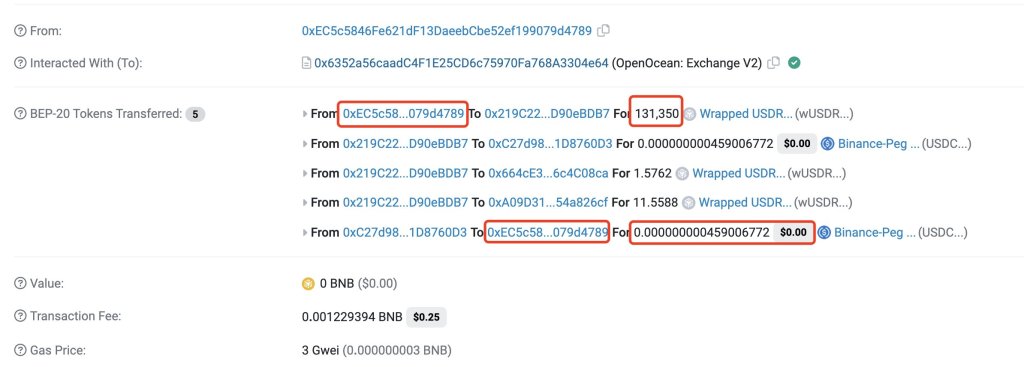

Lookonchain, a blockchain monitoring platform, now reveals that one stablecoin holder misplaced over $100,000 after panic promoting USDR, a stablecoin issued on the Polygon community, for zero USDC after it depegged on October 11. The stablecoin holder swapped 131,350 USDR for zero USDC, permitting an MEV bot to swoop in and declare $107,000 in revenue.

The USDR Depegging, Stablecoin Falls To $0.50

The stablecoin is issued by Tangible protocol, a decentralized finance (DeFi) protocol that claims to be tokenizing housing and different real-world belongings. Because of the immutable nature of the Polygon community, the USDR holder is now at a loss.

All on-chain transactions can’t be reversed except there’s a community rollback, which can unwind different transactions because of this ought to validators select to take action. Nevertheless, contemplating how public ledgers function, it’s unbelievable {that a} rollback will likely be executed to recuperate funds.

There has but to be any suggestions from the MEV bot operator on whether or not they can refund the affected person. Because the error was on the swapper’s facet and never the hack, the neighborhood’s response to this error stays largely muted.

Actual USD, USDR, is a stablecoin backed by a mix of different crypto belongings and actual property. Contemplating the stablecoin’s building, USDT is interest-bearing, that means holders obtain rewards. It was meant to trace the USD however misplaced its peg on October 11 after a wave of redemptions drained the venture’s treasury of its liquid belongings, together with DAI.

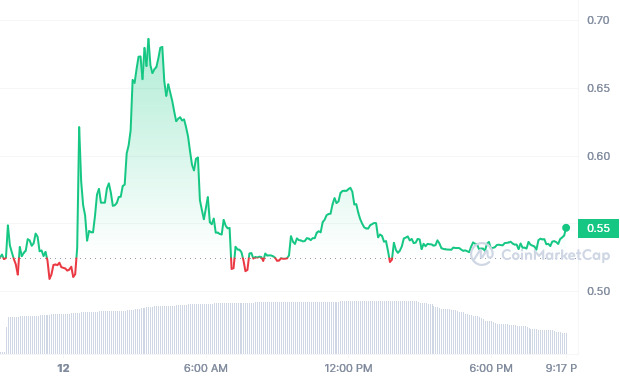

By the shut of October 11, USDR was buying and selling versus the USD at round $0.53, a close to 50% drop, triggering panic. Moments after the fast withdrawal of DAI and liquid belongings from its treasury, the workforce defined that USDR fell to as little as $0.50 earlier than recovering.

Tangible Finance Working On A Restoration Plan

Regardless of the depegging, the USDR issuer mentioned it’s engaged on making holders complete, saying the disaster is especially “liquidity associated.” It additionally tried to assuage holders, assuring that “the true property and digital belongings backing USDR nonetheless exist and will likely be used to help redemptions.”

Updating the neighborhood on X, the issuer mentioned it isn’t “going anyplace” and is engaged on a “plan”:

Tangible isn’t going anyplace. We have now a flywheel that works and plans to proceed constructing inside that. A vital a part of our shared future success is sustaining the belief we’ve established with our customers over the previous yr, which we hope to keep up by the plan beneath.

Past the panic promoting and one holder shedding over $100,000 to an MEV bot, the extent of the USDR depeg has not been absolutely quantified. As of October 12, Polyscan information exhibits over 2,400 USDR holders. In complete, they cumulatively management barely over 45.5 million of the stablecoin.

Characteristic picture from Canva, chart from TradingView