Welcome to the Could 2024 situation of the Newest Information in Monetary #AdvisorTech – the place we take a look at the large information, bulletins, and underlying tendencies and developments which might be rising on this planet of expertise options for monetary advisors!

This month’s version kicks off with the information that self-directed retirement planning software program supplier NewRetirement has raised a $20M Collection A spherical as the corporate demonstrates that its DIY instruments actually do flip a subset of shoppers into bona fide prospects for monetary advisors. Which positions the software program as both a white-labeled resolution for advisory companies that need a method to have interaction a excessive quantity of prospects of their funnel, or just an answer to transform its personal 70,000+ energetic customers into paying purchasers of NewRetirement’s personal monetary advisors. Particularly provided that NewRetirement has already managed to get some sizable 401(ok) suppliers and recordkeepers to supply the software program on a paid foundation to their personal plan contributors… which suggests NewRetirement is successfully getting paid to market its personal recommendation companies (a advertising funnel that pays for itself!?).

From there, the most recent highlights additionally characteristic a variety of different attention-grabbing advisor expertise bulletins, together with:

- Betterment Premium raises charges for its human CFP service to 0.65%, placing it remarkably near the 0.70% common income yield of the standard advisory agency, because the robo-advisor finally ends up emulating the human advisor service and pricing mannequin it as soon as sought to disrupt

- Belief & Will broadcasts a strategic partnership with LPL and its 22,000 advisors, as increasingly more advisory companies look to incorporate property doc preparation as a part of their suite of value-added companies to purchasers (whereas outsourcing the precise authorized work)

Learn the evaluation about these bulletins on this month’s column, and a dialogue of extra tendencies in advisor expertise, together with:

- A pair of latest analysis research (one from Cerulli, one other from Constancy) spotlight how “tech-savvy” companies with excessive expertise adoption are outgrowing the remainder… not by attracting extra purchasers with a greater digital expertise for purchasers, however just by discovering extra of their personal operational back-office efficiencies to have the ability to scale quicker

- The SEC serves up a collection of very sizable fines to make examples of economic companies companies that did not do sufficient to oversee their workers’ use of texting and different messaging apps (e.g., WhatsApp), in a reminder to all advisory companies that all business-related communication should be archived (and reviewed!)

- As the excitement and hype proceed round AI, a warning (coupled with a pair of enforcement actions) from the SEC to not have interaction in “AI-washing“… advisory companies that promote how they’re utilizing synthetic intelligence of their practices must be sure that they’re really doing so

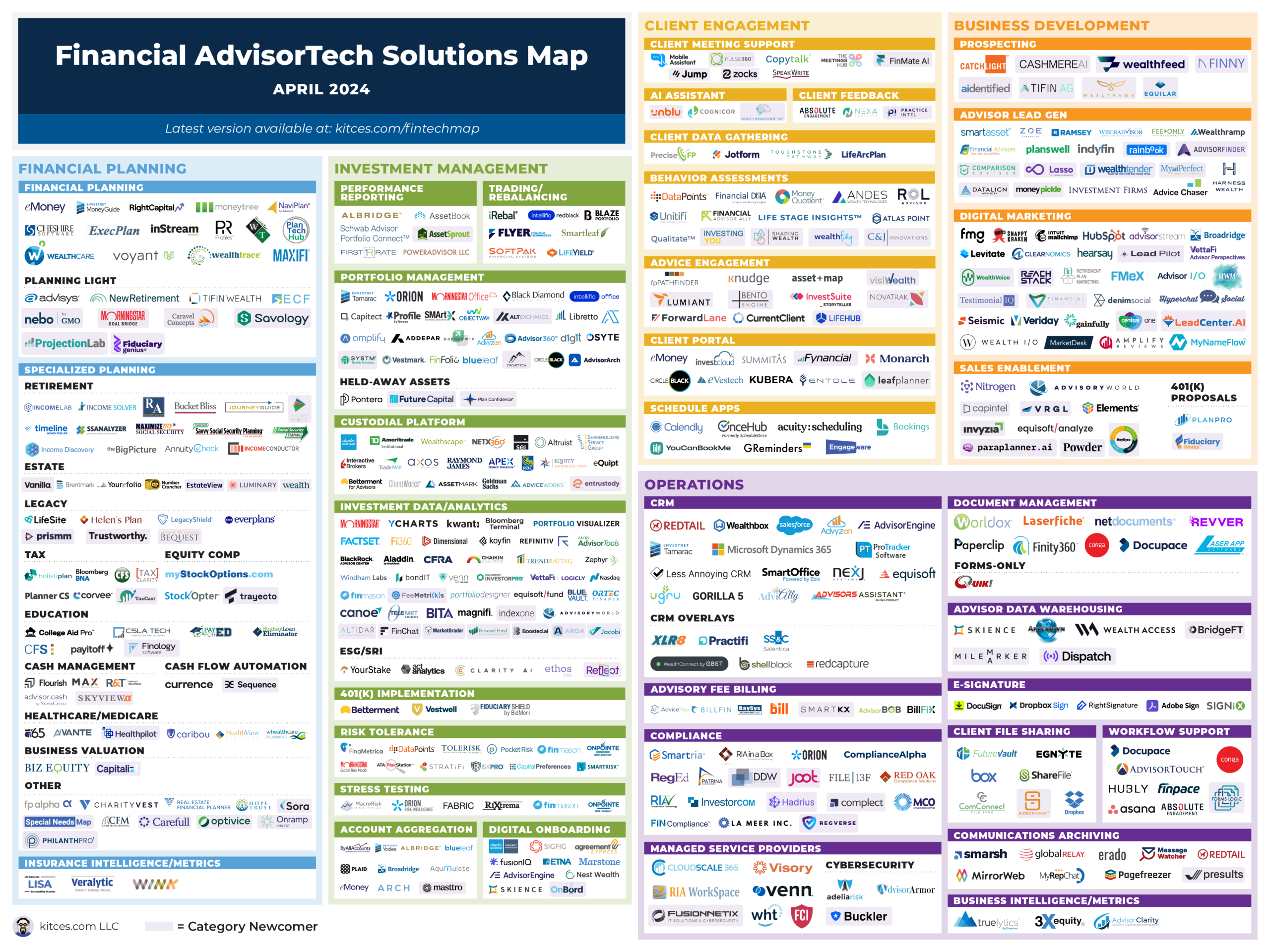

And be sure to learn to the tip, the place we’ve got supplied an replace to our common “Monetary AdvisorTech Options Map” (and in addition added the modifications to our AdvisorTech Listing) as properly!

*And for #AdvisorTech corporations who wish to submit their tech bulletins for consideration in future points, please undergo TechNews@kitces.com!